Even if you've been saving your money since you started to work, that may not be enough to ensure an enjoyable and satisfying retirement. Of course having enough money put away is the number one factor as to whether or not you'll maintain your desired lifestyle once you stop working. But don't overlook the small day-to-day stuff. Do you have a plan for things to do in retirement? How will you spend your time as a retiree? Do you already know what you will do with all that free time?

You probably started thinking about your retirement savings a long time ago. Perhaps you should start thinking about how you plan on spending your time too. This is a very important aspect of your retirement planning. You won't enjoy your free time if you haven't given it any thought before you quit full time employment. Think about it now so you can begin dreaming real dreams, as well as planning for any related expenses.

Perhaps you've already decided to spend more time with your family and just enjoy life. But in between the visits with family and friends, how will you fill your days? Perhaps you will spend your first year organizing your home, gardening, and all those home things you never had time or energy for while you were working. (Be sure to provide a budget for this in your retirement plan.) But you may lose interest once your home is perfectly organized and decorated. What then?

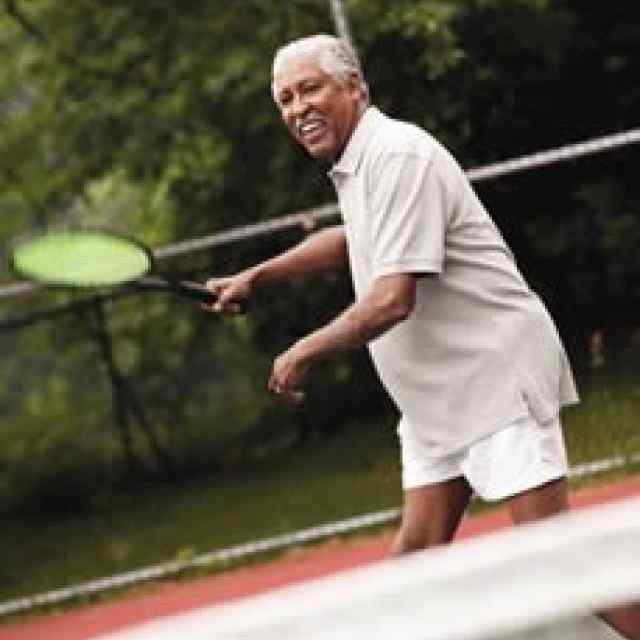

If you don't have retirement hobbies or pastimes before you retire, you really need to figure this out. It doesn't have to be about traveling to faraway places. It could be learning a new skill, craft, or sport. Take a class, start a book club or game club, or volunteer. Perhaps you should think back to before you started your career. What were your interests then? Did you have plans or dreams that you haven't attempted yet?

Maybe a small part-time job is all you need to get out of the house and meet other people. For some retired people working is very satisfying. It also has the added benefit of increasing Social Security benefits if you choose to draw it as late as age 70.

Retirement is a major lifestyle change and it is important to think in great detail about your plans for filling the days in your golden years before you get there so that you can make the transition smoothly and happily.